Find the latest information about Can You Cash A Check Made Out To A Business in this article, hopefully adding to your knowledge.

Cashing Checks Made Out to a Business: A Comprehensive Guide

Have you ever wondered if you can cash a check made out to a business? It’s a common question, especially if you’re a small business owner or freelance worker. The answer is yes, but there are some important things to keep in mind to ensure a smooth transaction.

In this blog post, we’ll cover everything you need to know about cashing checks made out to a business, including the different types of checks, required documents, and tips to avoid fraud. We’ll also provide answers to frequently asked questions at the end.

Types of Checks Made Out to a Business

There are two main types of checks that can be made out to a business:

- Business checks are issued by businesses to pay for goods or services. They typically have the business’s name and address printed on them.

- Cashier’s checks are a type of check issued by a bank. They are guaranteed by the bank and are considered a safer form of payment than personal checks.

Required Documents for Cashing a Business Check

Regardless of the type of check, you’ll typically need to provide the following documents to cash it:

- Government-issued ID, such as a driver’s license or passport

- Proof of business, such as a business license or tax ID number

- Bank account information, such as your account number and routing number

Some banks may have additional requirements, so it’s always best to call ahead and ask.

Tips to Avoid Fraud

When cashing a check made out to a business, it’s important to be aware of potential fraud scams. Here are some tips to help you avoid becoming a victim:

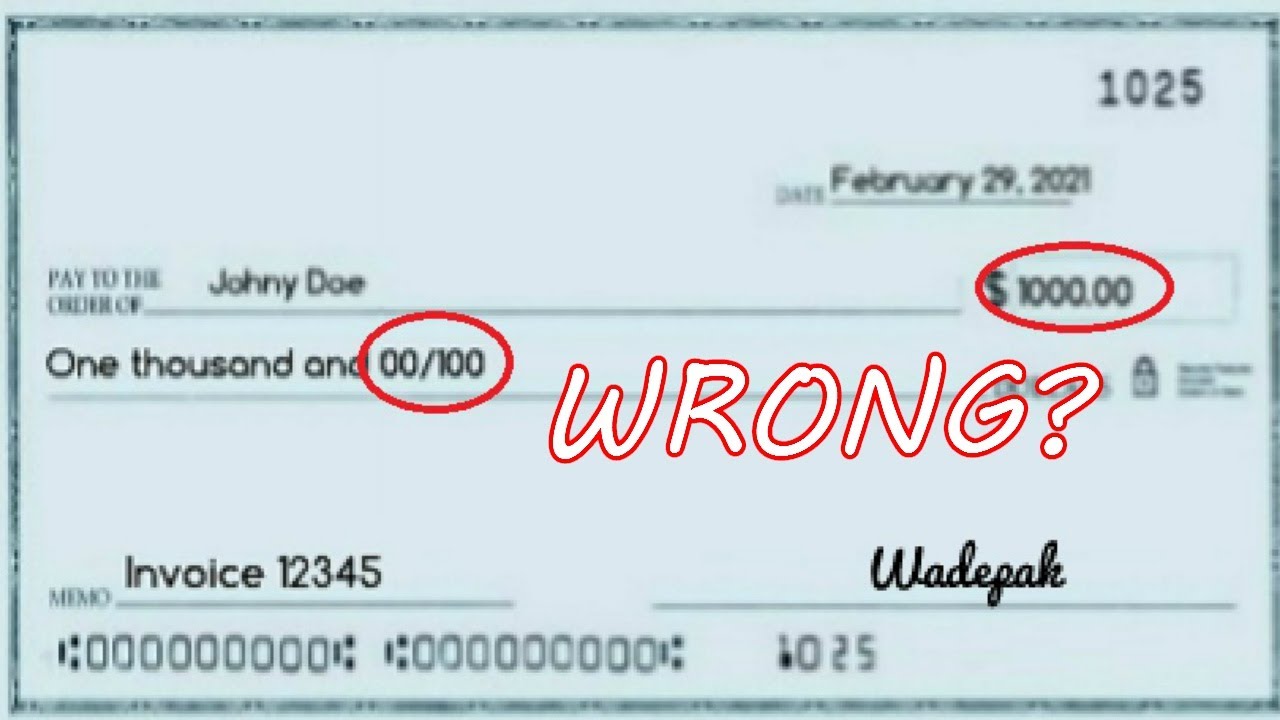

- Verify the check. Make sure the check is made out to the correct business name and that the signature is valid.

- Inspect the check. Look for any signs of alteration or forgery. The paper should be of high quality and the printing should be clear and crisp.

- Be cautious of large amounts. If a check is for a large amount, be extra vigilant. You may want to contact the business to verify the check’s authenticity.

Latest Trends and Developments

Trends in the banking industry are constantly evolving, and this includes the process of cashing checks. Here are some of the latest updates and news sources on the topic:

- Mobile check deposit. With mobile banking, you can now deposit checks using your smartphone or tablet. This is a convenient option for businesses that are on the go.

- Remote deposit capture. This technology allows businesses to scan checks and deposit them remotely, without having to go to a bank branch.

- ChexSystems. ChexSystems is a database that tracks check writing history. Businesses can use this database to identify customers who have written bad checks in the past.

Expert Advice

Based on my experience as a business blogger, here are some expert tips for cashing checks made out to a business:

- Establish a relationship with your bank. Get to know your bank teller and build trust. This will make it easier to cash checks and resolve any issues that may arise.

- Keep a record of all checks cashed. This will help you track your finances and identify any potential fraud.

- Be aware of your bank’s policies. Some banks have limits on the amount of money you can cash per day or month. Make sure you understand your bank’s policies before cashing a check.

Frequently Asked Questions

Here are some common questions about cashing checks made out to a business:

- Can I cash a check made out to my business even if I don’t have a bank account?

Yes, but you may need to pay a fee. Some check-cashing stores offer this service.

- What happens if I cash a fraudulent check?

If you cash a fraudulent check, you could be held liable for the amount of the check. It’s important to be aware of potential fraud scams and to take steps to protect yourself.

- How long does it take to cash a check?

The time it takes to cash a check varies depending on the type of check and the bank’s policies. Business checks and cashier’s checks typically take less time to cash than personal checks.

Conclusion

Cashing checks made out to a business can be a simple and straightforward process, but it’s important to be aware of the different types of checks, required documents, and potential fraud scams. By following the tips and advice in this article, you can safely and securely cash checks and avoid any hassles.

Are you interested in learning more about cashing checks? Let me know in the comments below.

Image: countrymusicstop.com

We express our gratitude for your visit to our site and for taking the time to read Can You Cash A Check Made Out To A Business. We hope this article is beneficial for you.